20+ How much to save for college per year information

Home » useful Info » 20+ How much to save for college per year informationYour How much to save for college per year images are available. How much to save for college per year are a topic that is being searched for and liked by netizens today. You can Download the How much to save for college per year files here. Get all royalty-free photos and vectors.

If you’re searching for how much to save for college per year images information related to the how much to save for college per year keyword, you have come to the right site. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

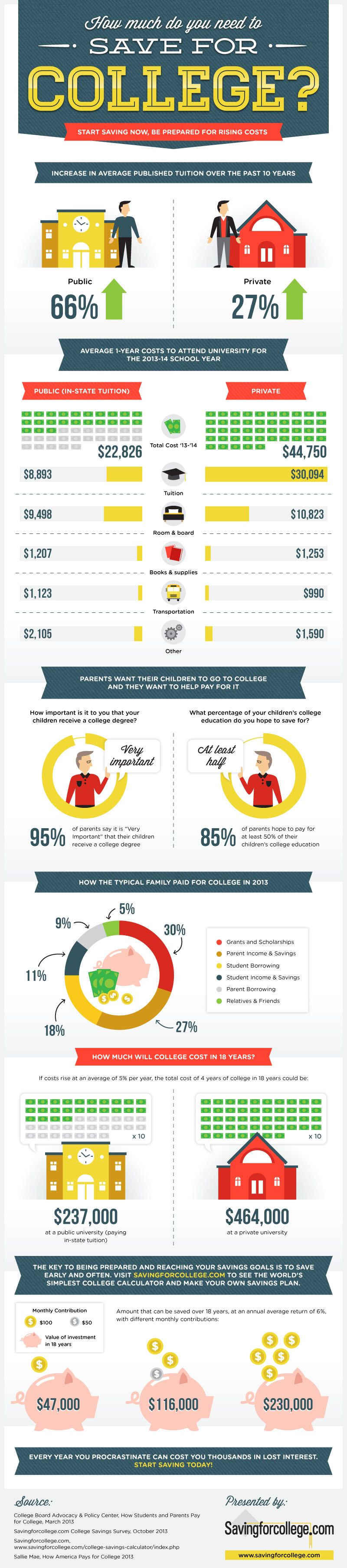

How Much To Save For College Per Year. The first two years of college (50% of the total cost). If you were to start saving the day your child was born, and were planning on paying the $201,108 with an 8% average return on your investments you would need to save $418.90/ month to be able to pay for your child’s total college expense. With these assumptions, you should be saving about $96 per month for your child�s college, or $1,151 per year. Students not receiving financial aid can expect to face, on average, from $450 to $1,630 more than last year for this year�s college expenses (tuition and fees, books and supplies, room and board), depending on the type of college.

Are you preparing to go to college? Do you know exactly From pinterest.com

Are you preparing to go to college? Do you know exactly From pinterest.com

Our calculator can help you determine how much to save for your kids’ college. A 4 year degree is estimated to be priced at $375,167.67 for students enrolling in 2039 if tuition increases average 7% per year until then. It combines a college cost calculator with a 529 college savings calculator. Mark kantrowitz, vice president of research at saving for college, suggests different goals depending on what type of school your child might attend: Over 10 years, that’s nearly $48,000 saved for college. Obtain a personalized projection of your future college costs by entering your child�s age, the type of college you�re saving for, and your household income.

As you can see, if you begin saving for college when your child is just a newborn, you can turn $64,800 in contributions ($3,600 a year x 18 years) into over $111,000, which represents a good.

But there is good news. Our calculator can help you determine how much to save for your kids’ college. And $118,900 for a private college. That adds up to $87,800 for four years at a state school and $199,480 at a private college. If you have kids now, even state schools will likely cost more than $100,000 by the time they are ready to. How to determine how much to save for college while we know that the average cost of college is $35,720 per year per student, that’s only part of the equation.

Source: pinterest.com

Source: pinterest.com

There is no one best way to save for college, but orsolini recommends squirreling away at least $25,000 to $40,000,. Use our compound savings calculator to see how much you should save each year in order to reach your financial goals. However, if you�re on the high end, and want to contribute to pay 100% of your child�s education expenses at a 4 year private college, i included that in the chart below too (for reference it means contributing $630 per month). Let�s see how that breaks down. That adds up to $87,800 for four years at a state school and $199,480 at a private college.

Source: pinterest.com

Source: pinterest.com

The first two years of college (50% of the total cost). Over 10 years, that’s nearly $48,000 saved for college. How much will it cost to send your child to college in 18 years and how much do you need to save? Mark kantrowitz, vice president of research at saving for college, suggests different goals depending on what type of school your child might attend: Tuition only (about 50% of the total cost for public schools;

Source: pinterest.com

Source: pinterest.com

The goal is to have saved $500,000 per child by the time he or she begins college. If you have kids now, even state schools will likely cost more than $100,000 by the time they are ready to. After age 18, $100,000 a year is to pay for college until the 529 plan goes to 0 at age 25. The first two years of college (50% of the total cost). The goal is to have saved $500,000 per child by the time he or she begins college.

Source: pinterest.com

Source: pinterest.com

And $118,900 for a private college. The published sticker price for a year’s cost of attendance was $18,550, but the average student received $3,990 in financial aid, resulting in a final average price of $8,860 in tuition and. As you can see, if you begin saving for college when your child is just a newborn, you can turn $64,800 in contributions ($3,600 a year x 18 years) into over $111,000, which represents a good. Over 10 years, that’s nearly $48,000 saved for college. When northwestern mutual wealth management advisor mark kull helps clients determine how much they will have to save, he assumes that tuition will go up 5 percent per year — which is about how much they have increased annually over the last 10 years.

Source: pinterest.com

Source: pinterest.com

Those who should follow the medium column: Those who should follow the medium column: A 4 year degree is estimated to be priced at $375,167.67 for students enrolling in 2039 if tuition increases average 7% per year until then. If these numbers seem daunting, don’t worry. Say you’re planning for a child who’s 4 years old today.

Source: pinterest.com

Source: pinterest.com

With these assumptions, you should be saving about $96 per month for your child�s college, or $1,151 per year. Over 10 years, that’s nearly $48,000 saved for college. When northwestern mutual wealth management advisor mark kull helps clients determine how much they will have to save, he assumes that tuition will go up 5 percent per year — which is about how much they have increased annually over the last 10 years. Using the college education savings calculator. Aim to save 15% of your salary for retirement — or start with a percentage that’s manageable for your budget and increase by 1% each year.

Source: pinterest.com

Source: pinterest.com

There�s more financial aid available than ever before — $227 billion, or $13,914 per. Find your own ‘best’ way to save for college. There is no one best way to save for college, but orsolini recommends squirreling away at least $25,000 to $40,000,. Room and board, books, and fees (about 50% of the total cost for public schools; Following this formula, a family making an average of $100,000 annually might save 10% of the remaining $47,600, or $397 per month.

Source: pinterest.com

Source: pinterest.com

If you were to start saving the day your child was born, and were planning on paying the $201,108 with an 8% average return on your investments you would need to save $418.90/ month to be able to pay for your child’s total college expense. Say you’re planning for a child who’s 4 years old today. Those who should follow the medium column: A general rule of thumb is to have one times your income saved by age 30, twice your income by 35, three times by 40, and so on. As you can see, if you begin saving for college when your child is just a newborn, you can turn $64,800 in contributions ($3,600 a year x 18 years) into over $111,000, which represents a good.

Source: pinterest.com

Source: pinterest.com

The goal is to have saved $500,000 per child by the time he or she begins college. A 4 year degree is estimated to be priced at $375,167.67 for students enrolling in 2039 if tuition increases average 7% per year until then. As you can see, if you begin saving for college when your child is just a newborn, you can turn $64,800 in contributions ($3,600 a year x 18 years) into over $111,000, which represents a good. Tuition only (about 50% of the total cost for public schools; It combines a college cost calculator with a 529 college savings calculator.

Source: pinterest.com

Source: pinterest.com

Find your own ‘best’ way to save for college. Using the college education savings calculator. Our calculations show that a parent whose child will begin college in 10 years would need to save about $322 a month in order to have enough cash to pay for four years of a public education. Use our compound savings calculator to see how much you should save each year in order to reach your financial goals. If you start with $1,000 and save an.

Source: pinterest.com

Source: pinterest.com

If you start with $1,000 and save an. Obtain a personalized projection of your future college costs by entering your child�s age, the type of college you�re saving for, and your household income. For example, you might plan to save enough for: Find your own ‘best’ way to save for college. If you were to start saving the day your child was born, and were planning on paying the $201,108 with an 8% average return on your investments you would need to save $418.90/ month to be able to pay for your child’s total college expense.

Source: pinterest.com

Source: pinterest.com

With a student working 10 hours per week for 50 weeks per year at the current $7.25 minimum wage, that’s an additional $3,625, for a total contribution of $14,500 over four years. There�s more financial aid available than ever before — $227 billion, or $13,914 per. And $118,900 for a private college. Our calculator can help you determine how much to save for your kids’ college. The savings is more important than you might realize.

Source: pinterest.com

Source: pinterest.com

There is no one best way to save for college, but orsolini recommends squirreling away at least $25,000 to $40,000,. Obtain a personalized projection of your future college costs by entering your child�s age, the type of college you�re saving for, and your household income. Over 10 years, that’s nearly $48,000 saved for college. How much will it cost to send your child to college in 18 years and how much do you need to save? 52 rows how much does college cost?

Source: pinterest.com

Source: pinterest.com

How much will it cost to send your child to college in 18 years and how much do you need to save? A general rule of thumb is to have one times your income saved by age 30, twice your income by 35, three times by 40, and so on. That adds up to $87,800 for four years at a state school and $199,480 at a private college. There�s more financial aid available than ever before — $227 billion, or $13,914 per. When northwestern mutual wealth management advisor mark kull helps clients determine how much they will have to save, he assumes that tuition will go up 5 percent per year — which is about how much they have increased annually over the last 10 years.

Source: pinterest.com

Source: pinterest.com

5 as the years to goal, and 2% as the annual rate of return if you already have $1,000 saved up, enter $1,000 as your current amount saved. It combines a college cost calculator with a 529 college savings calculator. How to determine how much to save for college while we know that the average cost of college is $35,720 per year per student, that’s only part of the equation. That adds up to $87,800 for four years at a state school and $199,480 at a private college. How much will it cost to send your child to college in 18 years and how much do you need to save?

Source: pinterest.com

Source: pinterest.com

According to collegeboard.com, “nearly half (47. Over 10 years, that’s nearly $48,000 saved for college. And $118,900 for a private college. There is no one best way to save for college, but orsolini recommends squirreling away at least $25,000 to $40,000,. The medium column assumes a $15,000 annual contribution every year until 18 with a 6.2% compound annual return.

Source: pinterest.com

Source: pinterest.com

Room and board, books, and fees (about 50% of the total cost for public schools; How to determine how much to save for college while we know that the average cost of college is $35,720 per year per student, that’s only part of the equation. The goal is to have saved $500,000 per child by the time he or she begins college. If you start with $1,000 and save an. For example, you might plan to save enough for:

Source: pinterest.com

Source: pinterest.com

Mark kantrowitz, vice president of research at saving for college, suggests different goals depending on what type of school your child might attend: The savings is more important than you might realize. However, if you�re on the high end, and want to contribute to pay 100% of your child�s education expenses at a 4 year private college, i included that in the chart below too (for reference it means contributing $630 per month). There is no one best way to save for college, but orsolini recommends squirreling away at least $25,000 to $40,000,. 5 as the years to goal, and 2% as the annual rate of return if you already have $1,000 saved up, enter $1,000 as your current amount saved.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much to save for college per year by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.